eCommerce: 11 Things Every Online Seller Should Be Writing Off on Their Taxes

Posted by Big Brand Wholesale.com on 22nd May 2020

Most online sellers I have chatted with do not understand how taxes work in general, let alone how write-offs work and how important they are. Write offs are so important, that in your first several years of business you likely will get a LARGER tax return check because you have a lot of costs to get rolling! Here’s a simple example of how writeoffs work that we used in yesterdays article:

Damaged inventory is a TAX WRITEOFF. It goes in the “Loss” Category.

Let’s say you pay $1,000 for 100 pieces of clothing. This means you paid $10 per piece.

Let’s say 20 pieces are totally unsellable. This means $200 of the $1,000 you spent is a write-off.

Now let’s say you sell the remaining 80 perfect pieces for $40 each and make $3,200 total (AKA “Gross Profit”.)

After you deduct the money you spent on the merchandise, (sold for $3,200 - $1,000 cost) you end up with $2,200 adjusted profit (AKA: “Net Profit”).

This means you would owe the government taxes on $2,200.

But wait… you need to deduct your write off! You had the 20 unsellable pieces that cost you $200, so the government lets you take $200 “Loss” off of the $2,200 you owe taxes on….

So now you only owe taxes on $2,000 instead of $2,200!

Taxes are roughly 20% of your net profit, so if you did NOT “write off” your $200 loss, you would be giving the government an additional $40 for no reason at all!

Maybe $40 doesn’t sound like enough money to make the writeoff worth your time, but in 1 years time, once you add up all of your damages, breakage, expired products, etc you’ll be amazed at what the number comes to! We have about $35,000 of totally legitimate loss every year just from products we were shipped by Big Brand Stores that are utterly unsellable to our buyers. If we did not save all of our damages to write them off, we would be giving Uncle Sam at least $7,000 for nothing! That's a lot of money to throw away on top of literally throwing away the extreme damages!

But “Damages” are NOT the only thing you should be writing off! Here’s a brief list of other writeoffs you should be taking advantage of:

- Supplies - your pc paper, your shipping labels, did you buy ink pens? Pads of paper? A computer mouse pad? Mailers? I know you have bought tape! Did you invest in a new scale? What about new SD Cards for your camera?

- Costs - This is a heavy hitter! You should be writing off ALL of your expenses associated with the selling of your merchandise: SELLING FEES, Closing costs, “store fees”, chargeback fees. All of your accounts should allow you to download a “Year End Total” that shows you all of your expenses, fees, etc regarding their platform.

- Other Costs: POSTAGE!!!! We spend $50,000+ a year on postage! Thats a huge writeoff!

- Electronics Purchases - A new computer is expensive yet a cost of doing business. A new camera can be $1,000 but is a requirement of an eCommerce seller. A new light box, new photo lights, an upgraded scanning gun… all of these are writeoffs.

- Other Stuff - Computer chair, desk, photo backgrounds. You can even writeoff the fancy rug you bought to go under your pc desk or the lumbar support for your chair.

- Promotional Merchandise - If you purchased business cards, logo pens, etc make sure you write these off too!

- CREDIT CARD FEES! Don’t forget that every time you receive a payment you are paying for a “swipe” (usually about 30-cents) in addition to a fee of around 2.5%-3.5% of the total transaction. If you sell internationally, the fee is usually increased to around 5%. If you also have to pay for “currency exchange” this can add a lot of additional costs that you might not be considering.

- Returns & Refunds - If merchandise was returned, the entire sale is canceled. Why pay taxes on funds that were reversed?

- Inventory - This isn’t exactly a “writeoff” but it is an expense that is recognized and you absolutely need to claim the expense. If you spend $10,000 a year on inventory, why would you not count this amount?! When your business grows and you are spending $500,000 - 1 million+ on inventory, you absolutely want the government to know “Hey, I reinvested a LOT of profit! I didn’t use this money to vacation in Tahiti!”

- Gasoline - If you are driving around to find inventory or make daily trips to the post office, you can start a “mileage log”. Write down the mileage number your vehicle starts at and stops at each time you make a business trip. For example: “START 76,000 miles. END 76,029 miles” - this would mean you can write off 29 miles for this specific day. The amount you can writeoff is something like 65-cents per mile, so it does add up.

- BILLS - This one gets tricky because you MUST stay in compliance of the law… and there’s a ton of totally bogus information online. You CAN writeoff your vehicle IF it is strictly used for business. For example, I can NOT write off my Mercedes because it’s my “daily transportation” that I sometimes also use for business.

You CAN write off your cell phone, but only IF it is strictly for your company. I cannot write off my phone either. But if you had a 2nd phone line that was your business number you could writeoff 100% of this cost. Or, if you pay a monthly fee for upgraded Skype or a computer-calling number, you absolutely can write this off.

This is the same with other bills, such as Utilities. If you rent an actual office, you can write off all of it but if you work from home, you’re kind of SOL because you cannot claim your $200 a month electric bill for your home as a “work expense” because it simply isn’t. You COULD go through the work of determining the exact sq ft of space your home business takes up then divide all bills according to sqft but this can also get kind of messy. I do not advise this.

TIPS: Look at your bank statements. Print out a couple months worth. Go through with a highlighter and highlight everything that is an expense for your business. It’s amazing to see how much stuff you never even considered that you are spending. As an example, your annual cost to renew your LLC or your .com site or even shipping fees you were charged.

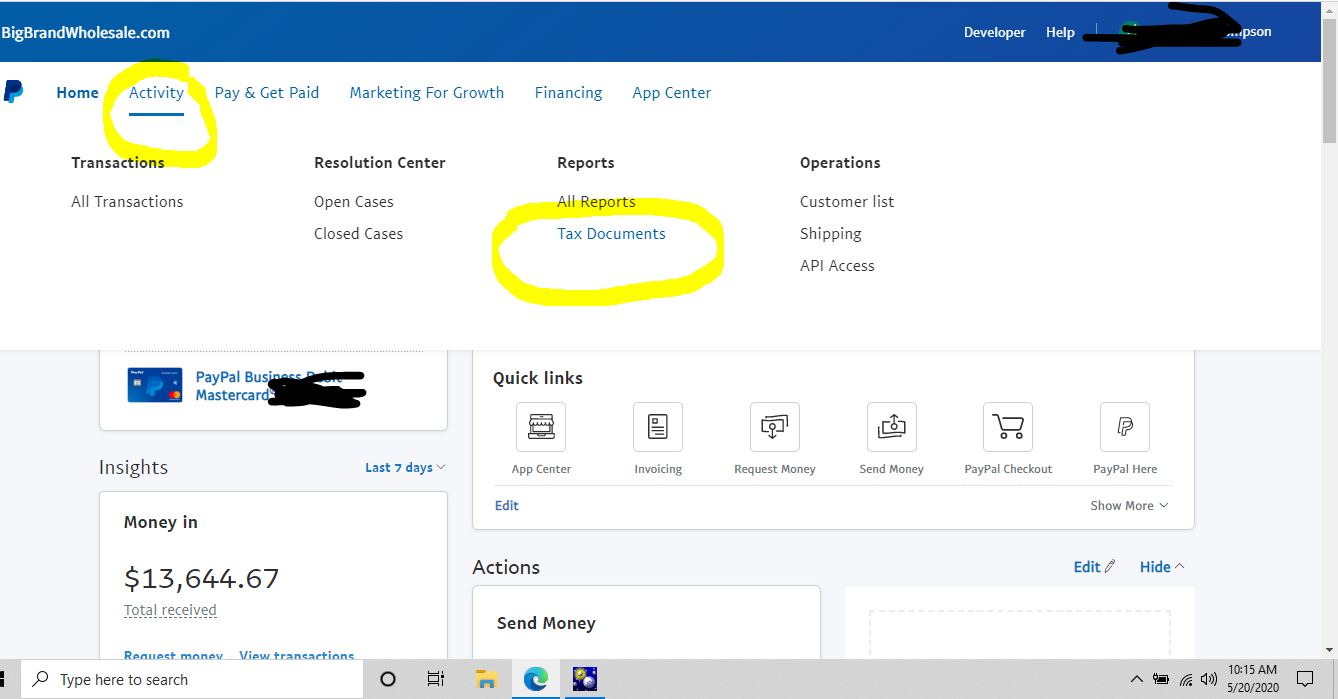

If you use PayPal, you can quickly and easily run reports by going to the "Activity" then "Reports" section:

THINGS TO AVOID WRITING OFF

You’ll hear blatant lies online that tell you that you can writeoff all “Work Clothing”. This USED TO BE TRUE. But people were taking gross advantage of this so the law changed several years ago. The newer law is that you can write off LOGO apparel… meaning if you pay for shirts or hats that say your company name. Besides that, there are limits on what can be claimed. I believe if you work in certain industries you can claim specific things; for example, my husband can claim 1 pair of steel toe work boots per year and a couple other, relatively trivial, things. Long gone are the days of writing off $3,000 Armani suits or Fendi purses.

Don’t claim stuff that you know can’t be claimed because it isn’t a legit expense. An audit is terrible. The last thing anyone wants is the government digging through years and years of their finances. Don’t write off personal furniture, televisions, home remodeling, gifts (although I suppose you could write off a gift you gave to a coworker or good customer), landscaping or other stuff like that. You CAN write off the expense of moving BUT if you are moving from one home-business to a new home-business, don’t risk writing off your entire cost of moving your home.

Where to Next? Popular Topics: